by ravenhealth | Nov 18, 2024 | Blogs

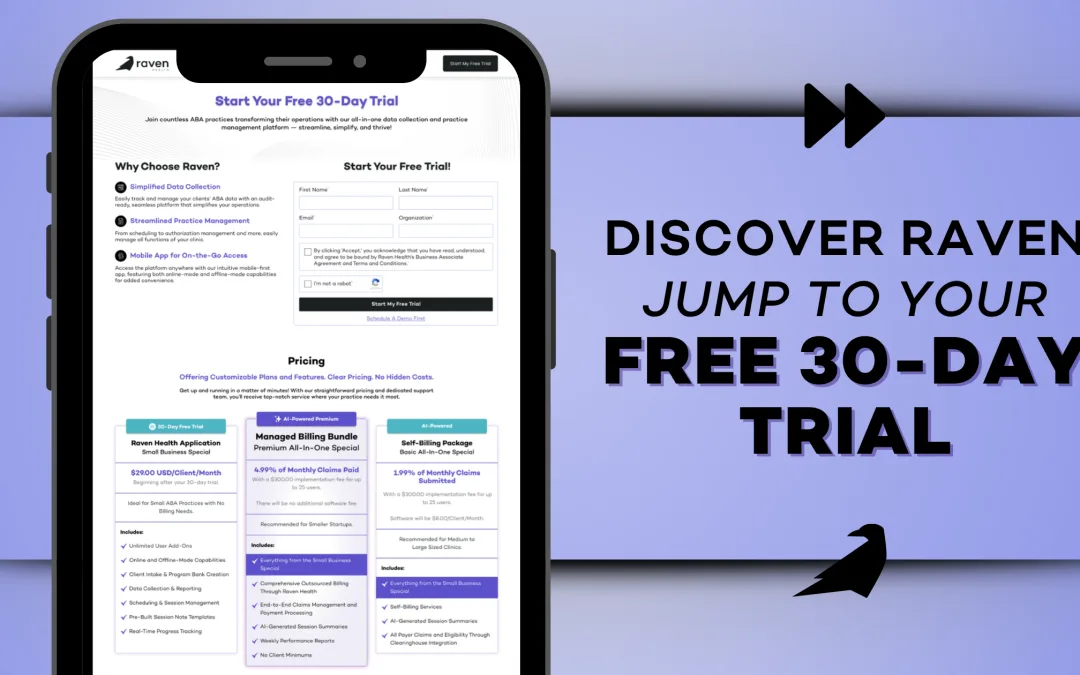

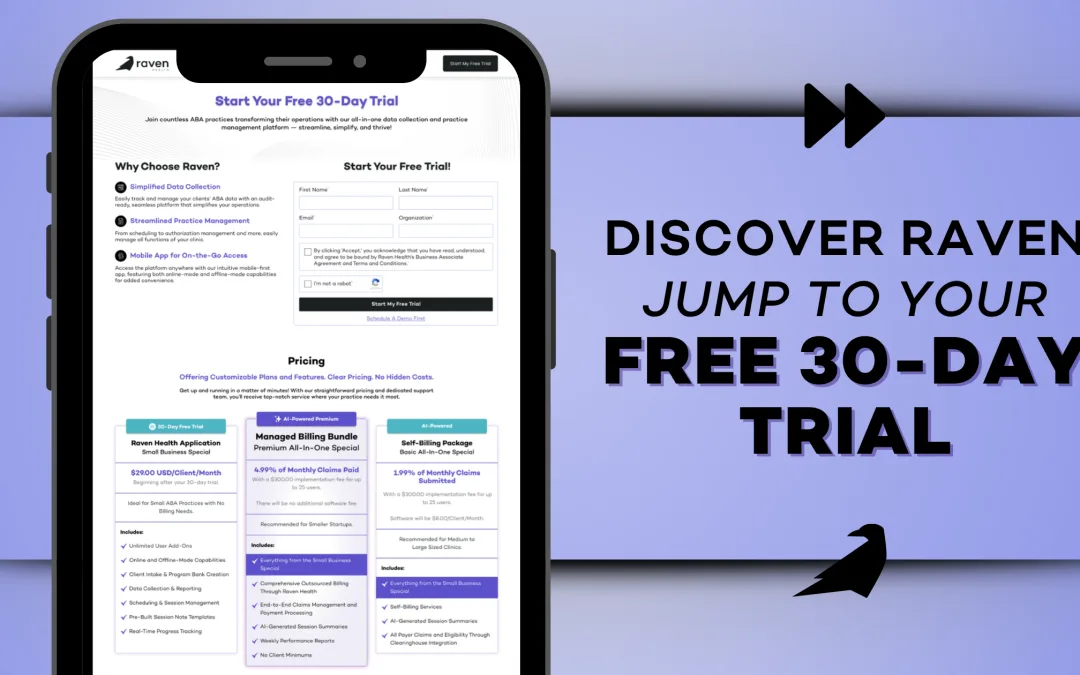

Ready to see why so many ABA professionals are turning to Raven Health? With our 30-day free trial, you can experience the full power of our platform without any strings attached—no credit card required. Dive into features designed to streamline your workflow, simplify data collection, and help you focus on what truly matters: your clients.

What’s Included in Your Free Trial:

Your trial unlocks a world of Raven Health’s core tools and features, designed to elevate your ABA practice. Get hands-on experience with these powerful resources that simplify your workflow and enhance client care. Here’s a sneak peek at what awaits you:

- Simplified Data Collection: Track client progress with tools tailored for both skill acquisition and behavior tracking. Record responses in real-time with flexibility for every ABA program.

- Seamless Scheduling: Set up sessions effortlessly with customizable options for one-time or recurring appointments. Our intuitive scheduling ensures smooth session planning, avoiding double bookings, and keeping your practice organized.

- Efficient Session Notes & Documentation: Document sessions quickly with customizable templates and the option to save unfinished notes. Everything is right at your fingertips, ready to continue whenever you are.

- Offline Mode for Ultimate Flexibility: Collect data on-the-go, even without an internet connection. Offline entries sync automatically when you’re back online, so you never miss a beat.

- Personalized Launchpad: Start each day with your launchpad—a dashboard showing your sessions, outstanding notes, and client details, all in one organized view.

- Easy Team Collaboration: Add staff members, assign clients, and manage multiple users seamlessly. Create custom programs that can be reused for different clients, saving time and enhancing collaboration.

Why Try Raven Health?

With no financial commitment or credit card required, this trial offers an authentic look at how Raven can transform your practice. From optimizing session management to empowering data-driven decisions, our platform is designed with ABA clinicians in mind—by a team that understands the field.

Ready to Elevate Your Practice?

Start your 30-day free trial today and experience Raven Health firsthand. Prefer a guided tour? We still offer demos, but now you can explore at your own pace and see how Raven can support your success. Sign up HERE and take the next step in delivering exceptional care—effortlessly.

by Manoj Kumar | Nov 7, 2024 | Webinars

For ABA providers, navigating the complexities of the claims process can be daunting. From ensuring accurate documentation to staying on top of changing insurance policies, each step is crucial to maintaining a healthy cash flow. This blog walks you through the key elements of the ABA billing process and offers practical tips to expedite payments while avoiding common pitfalls.

The Importance of Accurate Data Entry

The first step to a successful ABA claims process is ensuring your data entry is impeccable. Even minor errors in client details, CPT codes, or service dates can lead to claim denials. Here’s how you can streamline your data:

- Double-check client information: Ensure that every client’s name, date of birth, and insurance details match what’s on file with the payer.

- Stay updated on CPT codes: Using the correct billing codes for ABA services is essential. Make sure your billing team is aware of any changes.

- Audit regularly: Regular audits of your claims before submission can catch mistakes early, saving you time in the long run.

Understanding Payer Requirements

Each insurance payer has its own set of rules for submitting ABA claims. Failing to follow these guidelines can result in delays or rejections. Here’s how to stay compliant:

- Know your payer’s policies: Keep a detailed file on each payer’s submission guidelines, including required documentation, deadlines, and appeal processes.

- Track claim status: Stay proactive by regularly checking on your claim statuses. Most payers allow you to monitor claims online, so set up reminders to review submissions.

- Appeal denials promptly: If a claim is denied, don’t wait. Review the reason for denial and submit an appeal as soon as possible.

Efficient Denial Management

Even with accurate data and a solid understanding of payer requirements, denials still happen. The key is to manage them efficiently. Here’s how you can take control of denials:

- Categorize and track denials: Use a system to categorize denials by type (e.g., authorization issues, documentation errors) so you can spot patterns and address recurring issues.

- Follow up quickly: The faster you respond to a denial, the quicker you can resolve the issue and get reimbursed.

- Train your team: Ensure your billing and administrative staff are trained to handle denials effectively. A well-trained team can reduce errors and speed up the resolution process.

Leveraging Technology to Streamline Claims

Adopting technology solutions can make a significant difference in the efficiency of your ABA claims process. Here’s how tech can help:

- Automate claims submission: Use a platform that automates data entry and claim submission to reduce manual errors and save time.

- Track key metrics: Analytics tools can provide insights into your claims process, highlighting areas for improvement and helping you optimize your workflow.

- Simplify communication with payers: A centralized system allows your team to communicate more easily with payers and stay on top of claim statuses and appeal deadlines.

Conclusion: How Raven Can Help

Navigating the ABA claims process can feel overwhelming, but with the right approach, you can streamline your operations and ensure faster reimbursements. Raven Health’s comprehensive platform offers data-driven insights, automated billing features, and support to simplify your claims lifecycle.

Ready to make your ABA billing process more efficient? Request a demo today and see how Raven Health can transform your practice.

Interested in learning more? Watch the free, full webinar below:

Click here to watch the webinar!

by ravenhealth | Nov 7, 2024 | Blogs

For ABA providers, navigating the complexities of the claims process can be daunting. From ensuring accurate documentation to staying on top of changing insurance policies, each step is crucial to maintaining a healthy cash flow. This blog provides key elements of ABA billing training and offers practical tips to expedite payments while avoiding common pitfalls.

For ABA providers, navigating the complexities of the claims process can be daunting. From ensuring accurate documentation to staying on top of changing insurance policies, each step is crucial to maintaining a healthy cash flow. This blog provides key elements of ABA billing training and offers practical tips to expedite payments while avoiding common pitfalls.

The Importance of Accurate Data Entry

The first step to a successful ABA claims process is ensuring your data entry is impeccable. Even minor errors in client details, CPT codes, or service dates can lead to claim denials. Here’s how you can streamline your data:

- Double-check client information: Ensure that every client’s name, date of birth, and insurance details match what’s on file with the payer.

- Stay updated on CPT codes: Using the correct ABA codes for therapy services provided is essential. Make sure your billing team is aware of any changes.

- Audit regularly: Regular audits of your claims before submission can catch mistakes early, saving you time in the long run.

Understanding Payer Requirements

Each insurance payer has its own set of rules for submitting ABA claims. Failing to follow these guidelines can result in delays or rejections. Here’s how to stay compliant:

- Know your payer’s policies: Keep a detailed file on each payer’s submission guidelines, including required documentation, deadlines, and appeal processes.

- Track claim status: Stay proactive by regularly checking on your claim statuses. Most payers allow you to monitor claims online, so set up reminders to review submissions.

- Appeal denials promptly: If a claim is denied, don’t wait. Review the reason for denial and submit an appeal as soon as possible.

Efficient Denial Management

Even with accurate data and a solid understanding of payer requirements, denials still happen. The key is to manage them efficiently. Here’s how you can take control of denials:

- Categorize and track denials: Use a system to categorize denials by type (e.g., authorization issues, documentation errors) so you can spot patterns and address recurring issues.

- Follow up quickly: The faster you respond to a denial, the quicker you can resolve the issue and get reimbursed.

- Train your team: Ensure your billing and administrative staff are trained to handle denials effectively. A well-trained team can reduce errors and speed up the resolution process.

Leveraging Technology to Streamline Claims

Adopting technology solutions can make a significant difference in the efficiency of your ABA claims process. Here’s how tech can help:

- Automate claims submission: Use a platform that automates data entry and claim submission to reduce manual errors and save time.

- Track key metrics: Analytics tools can provide insights into your claims process, highlighting areas for improvement and helping you optimize your workflow.

- Simplify communication with payers: A centralized system allows your team to communicate more easily with payers and stay on top of claim statuses and appeal deadlines.

Conclusion: How Raven Can Help

Navigating the ABA claims process can feel overwhelming, but with the right approach, you can streamline your operations and ensure faster reimbursements. Raven Health’s comprehensive platform offers data-driven insights, automated billing features, and support to simplify your claims lifecycle. Ready to make your ABA billing process more efficient? Request a demo today and see how Raven Health can transform your practice. Interested in learning more? Watch the free, full webinar below: Click here to watch the webinar!

by ravenhealth | Oct 20, 2024 | Blogs

When Crescent Bloom, an ABA school and community-based program in New Orleans, sought to grow, one major hurdle stood in their way: billing. As a busy practice owner and dual-licensed BCBA and LPC, Rebekah Cianci knew that billing management was taking too much time and energy away from her primary mission – supporting her clients. That’s when she turned to Raven Health’s Managed Billing services. Since partnering with Raven Health, Crescent Bloom has not only reduced stress but also improved efficiency in their billing processes. Here’s a glimpse into how our Managed Billing team has empowered Crescent Bloom:

Key Billing Achievements

- 97% Paid Rate: Our team ensures that claims are processed promptly, with ongoing resubmissions for any denials.

- Claims Paid in an Average of 10.31 Days: Raven is committed to fast results. Crescent Bloom’s claims have been paid swiftly, allowing for better cash flow and stability.

- Another Initiative to Help: Raven was able to recover old accounts receivable – funds that were previously thought lost or tied up in confusing claim corrections.

For Rebekah, these results have been transformative, freeing up her time and providing peace of mind. As she says, “The billing team has been incredibly effective, but also very kind and positive to work with. It takes a lot off my plate, not just in terms of daily billing, but in terms of feeling confident that they will make sure nothing falls through the cracks.”

A Team That’s Got Your Back

Rebekah works closely with Raven’s billing specialists Beth Sullivan, Arjay Retos, Kelli Fawver, and Laura Bundy. She highlights how supportive the team has been in tackling complex billing tasks, especially when it came to working through old A/R issues. “I had previously struggled with old A/R, particularly keeping track of if a corrected or adjusted claim had been paid. Having the billing team follow up on that has been wonderful – it was a worry that felt really unmanageable to get to on my own.” Raven Health didn’t just stop at the daily billing needs; they dug into the details. They worked alongside Rebekah to manage the complexities of being dually licensed as both a BCBA and LPC, ensuring all relevant CPT codes were correctly applied. Their approach? Diligent, proactive, and always full of positive energy. “Beth, Arjay, Kelli, and Laura asked clarifying questions and made sure we got set up correctly, even as we were all learning how to make it work together,” Rebekah notes.

Low Stress, High Efficiency

In the world of ABA, billing can feel like a mountain of paperwork, corrections, and follow-ups. Crescent Bloom’s story is a testament to the relief that Raven Health’s Managed Billing can provide. “Billing is probably the least fun part of my job, but they make sure it’s handled very diligently with positive energy and low stress,” says Rebekah. That’s the Raven difference – making the unmanageable feel manageable, so program owners like Rebekah can focus on what they do best.

Why Raven Health?

Raven Health’s Managed Billing service doesn’t just take tasks off your plate – it gives you confidence. Confidence that claims will be handled swiftly, denials won’t be forgotten, and every issue, from day-to-day billing to resolving old A/R, will be tackled with care. Rebekah sums it up perfectly: “It’s been such a wonderful investment that allows me to feel like my billing to-do list will be managed, and any issues will be brought to my attention.”

Final Thoughts

Crescent Bloom’s partnership with Raven Health proves that with the right team, even the most tedious aspects of running an ABA program – like billing – can become stress-free. We’re proud to support Rebekah and her team, helping their program thrive with Raven Health’s managed billing services. Want to see how Raven Health can transform your billing process? Let’s chat!

by ravenhealth | Oct 11, 2024 | Blogs

As the crisp fall air rolls in, it’s the perfect time to incorporate fun seasonal activities into your ABA therapy sessions! Here are 10 simple, engaging fall sensory ideas that BCBAs, RBTs, and practice owners can use to enhance client experiences while tapping into the magic of autumn.

- Pumpkin Sensory Bin Fill a bin with pumpkin seeds, small gourds, and fall leaves for kids to explore by touch and smell – a tactile treat!

- Apple-Scented Play-dough Create homemade play-dough scented with cinnamon or apple pie spice. Mold pumpkins or leaves while embracing those fall vibes.

- Leaf Rubbing Art Grab some fallen leaves, place them under paper, and let kids create textured rubbings with crayons – simple yet sensory-packed!

- Corn Kernel Sensory Bottles Fill clear bottles with dried corn kernels and fall trinkets for a calming, visually stimulating activity.

- Pumpkin Gut Exploration Scooping out pumpkin guts is messy but oh-so-fun! Explore the slimy texture while sorting seeds – perfect for sensory seekers.

- Fall Scent Exploration Set up scent jars filled with cinnamon, apples, and cloves. Let kids sniff and identify the smells of the season.

- Autumn Water Beads Use orange, red, and yellow water beads in a sensory bin – kids can sort by color or simply enjoy the soothing textures.

- Crispy Leaf Walk Head outside for a sensory walk through crunchy leaves – engage their auditory and tactile senses while enjoying nature.

- Harvest Sensory Bin Fill a bin with dried corn, pinecones, and mini pumpkins for a sensory-rich exploration of fall textures.

- Apple Stamping Art Cut apples in half, dip them in paint, and stamp away! A creative and tactile activity that captures fall’s spirit.

These activities are not only fun but are also designed to engage multiple senses, making them perfect for fall ABA sessions. So grab your pumpkins and play-dough, and let’s dive into a season of sensory exploration!